September – what a month. In Vancouver, not only did we have to deal with a pandemic, but our skies filled with smoke and our air quality became dangerous, as wildfires continued to rage south of the border.

Staying indoors with the windows shut was soul crushing, especially when the only way you can safely see most people is outdoors.

Aside from that, we also had a very high expenditure month, for various reasons I’ll explain below. Thankfully, Tim’s contract got extended again, and I continued in my new position working from home, so we’ve still managed to invest in September.

Here’s how it all shakes down:

Income

| Paycheques | $11,272 |

| Credit Card Cashback | $214 |

| Parking Spot Rent | $50 |

| Reimbursement | $13 |

| Interest Income | $13 |

| TOTAL | $11,562 |

This month, our paycheque income was much more normal, because there wasn’t much overtime for Tim to do. As much as it lowered our income, it doesn’t matter one bit – it’s been awesome to have him around to make dinner and chill out together!

The $13 reimbursement was for some coffees bought by Tim for his team and expensed, $13 of interest income came from our high interest TFSAs at Tangerine, and $50 came from renting out our parking space to a neighbour every month.

Free money highlights:

Our credit cards just keep giving cash back, specifically Tim’s Rogers World Elite Mastercard and Tim’s American Express Simply Cash card, which combined paid out $214 this month.

Also this month, I signed up for my own American Express Simply Cash card, so we can switch to using that for everything possible and get a bonus cashback rate of 2.5% on everything for the first three months!

Overall, income was a very healthy, at $11,562.

Expenses

| Mortgage | $3,662 |

| Strata Fees | $932 |

| Groceries | $767 |

| Liquor | $422 |

| AirBnb | $369 |

| Healthcare | $304 |

| Property Tax | $228 |

| Eating or Drinking Out | $221 |

| Personal Care | $192 |

| Tech Savings | $100 |

| Clothing | $94 |

| Internet | $87 |

| Education | $86 |

| Cellphones | $47 |

| Credit Card Interest | $43 |

| Home Insurance | $34 |

| Gift | $32 |

| Pet Shop | $22 |

| Charity Donation | $20 |

| Homewares | $20 |

| Apple Music Subscription | $17 |

| Adobe Subscription | $15 |

| Netflix | $14 |

| Disney+ | $10 |

| Garden | $8 |

| Fees | $5 |

| Online Storage | $3 |

| Cryptocurrency | $2 |

| TOTAL | $7,756 |

Our spending in September was way, way up, for a few reasons, some in our control, and others definitely not.

Let’s start with the mortgage. This month, there was a mix up at the bank, and as a result we made both our usual monthly payment, plus one weekly payment, which meant we paid $713 more than normal.

Then the groceries, which are pretty average at $767. It’s worth mentioning though, we have started stocking the freezer up again. This month that involved buying 20 pounds of tomatoes from a farm and turning it into a huge batch of tomato sauce!

Next, those strata fees. One of the annoying things about living in a strata is that often the AGM, where owners vote on any strata fee increases, is held months after the start of the fiscal year.

If a strata fee increase is voted through, then the increase is back dated until the beginning of the fiscal year, and taken as a lump sum from you the following month.

Because Covid had delayed our AGM for many months, it meant that the sum of the back dated payments was big. Like an extra $514! I really don’t like how they are allowed to do that, as it makes it very difficult to budget properly for it.

Anyway, the next extra expense was AirBnB at $369. This was our choice – we’re going for a long weekend on Vancouver Island in November and this was the first half of the payment for the accommodation. Because we all need a break from this year.

Healthcare also hit us hard this month, with some regular medications coming due for a refill at a cost of $304. Hopefully this is the last medical bill I have to pay for a while, as soon I’ll have extended benefits through my new job.

Eating and drinking out rose significantly this month to $221. Simply, there were some opportunities to see friends, safely social distancing on an outdoor patio, that we hadn’t anticipated and we took the chance to spend time with them.

The personal care spend was so big because we finally bought some proper haircutting shears at a cost of $178 (or about the same price I used to pay for one haircut). Tim made do cutting my hair with some blunt scissors during the pandemic, when hairdressers were closed, but these new shears will mean we can do this indefinitely, saving a lot of money in the process.

A few other small things to mention. Education this month included paying to get access to the Smith Manoeuvre Calculator, as I am researching whether to get a HELOC when we renew our mortgage, and begin the Smith Manoeuvre.

Rather shamefully, Tim forgot to pay one of the credit cards, and so we incurred Credit Card Interest of $43 without realizing it this month. Many of our credit cards are in his name, because I have struggled to get approved, so he shoulders a lot of the burden of moving the money around to pay the credit card bills. We’ve all been there, I know I have, so we didn’t dwell on it.

Speaking of which, I had to pay $5 in Fees this month, because I decided to buy $2 of Ethereum cryptocurrency on Coinbase as an experiment, and the credit card company considered that a cash withdrawal and charged me. I won’t do that again.

Overall, spending was higher than I wanted at $7,756.

FIRE Savings

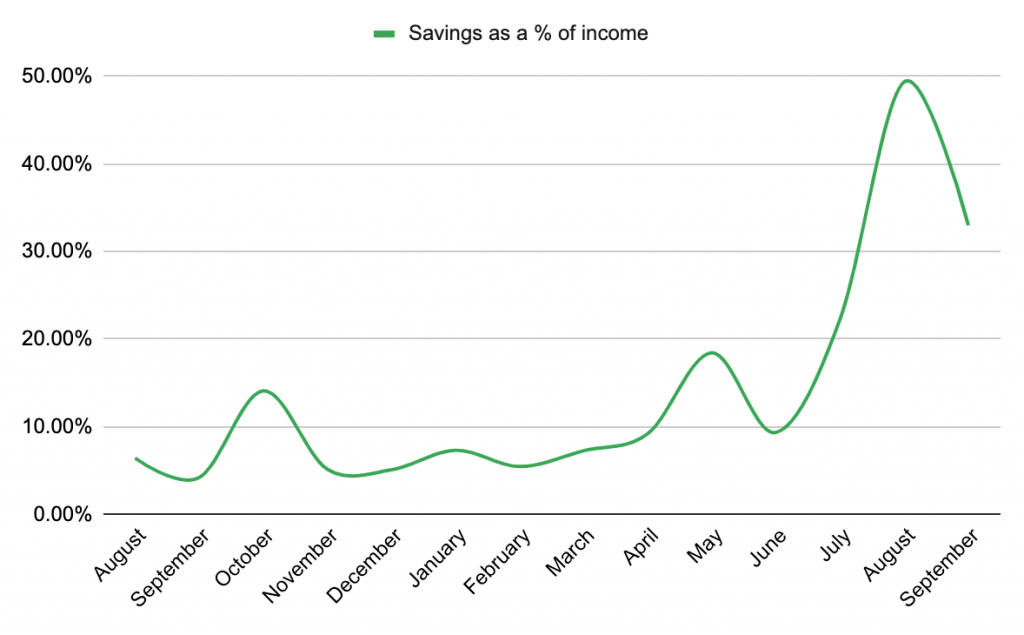

After balancing our budget, we figured that this month, we had $3,814 spare to put towards our FIRE savings. This is less than August, but still a healthy 33% of this month’s income.

The whole lot all went straight into our RRSPs at Questrade and brought our total FIRE savings to $219,169 as of October 1.

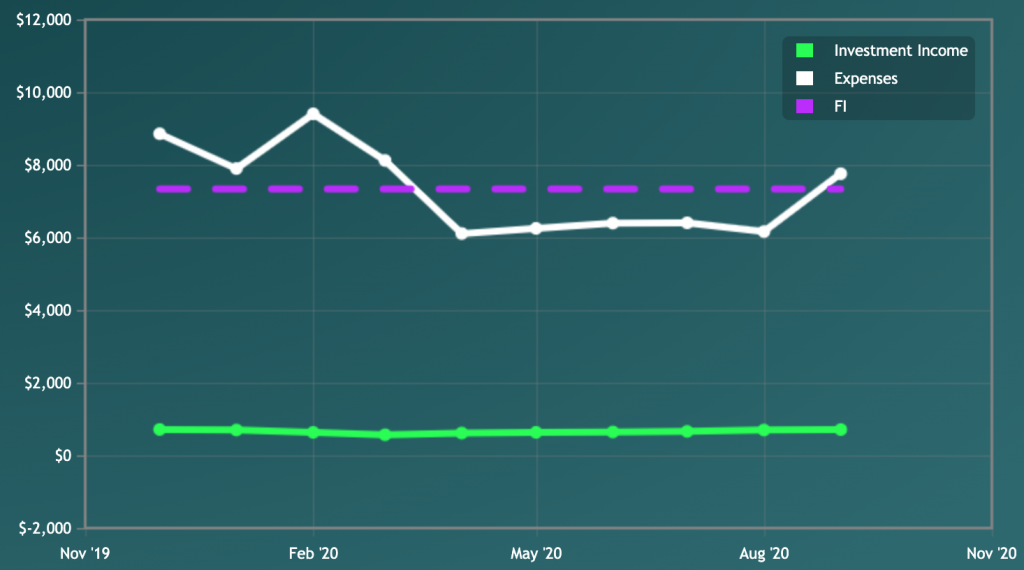

Plugging all these numbers into the Mad Fientist‘s FI Laboratory gives me the below graph, and the expected FI date of February 2043.

(Sure, I know it’s not the whole picture, but I like to input the numbers and see the difference anyway.)

According to the FI Laboratory, we’ve moved nine months closer to FI in September. Last month’s estimated FI date was November 2043. Slowly but surely, we will get there.

On a personal note, like everyone else in the world, we are tired of the pandemic and the effect it has had on our lives, our friends, and our families this year. We are also bracing ourselves for a winter that might see numbers and restrictions rise.

But we are trying to prepare ourselves by stocking up the freezer, making exciting plans for October and November within our strong bubble of six, and keep connected with friends who are not in our bubble, even if we have to physically distance.

Financially, in October, we expect Tim to be out of work for a while, since his contract ends on October 8, and he has nothing lined up afterwards yet. Hopefully he will find something, but his industry is very unpredictable right now.

That’s all from me this month. I hope your September went well!

I’m Daisy, the writer behind Fire by the Sea, my blog all about seeking financial independence in Vancouver, Canada. I love hiking, snowboarding, travelling, and cheese. You can read more about me, and my partner Tim, right here.

Contact me at daisy@firebythesea.ca.