This October in Vancouver was really strange. Some days, it was gloriously hot and sunny, other days, the Arctic air blew in and we sat freezing our asses off. And the pandemic is getting worse.

Likewise, we had a mixed month financially. We earned less – Tim was let go – and we spent more, for various reasons I’ll explain below.

But we still managed to invest a significant amount in October. Here’s how it all shakes down:

Income

| Paycheques | $9,515 |

| Reimbursement | $891 |

| Parking Spot Rent | $50 |

| Interest Income | $10 |

| TOTAL | $10,467 |

This month, our paycheques were smaller than normal, because Tim was let go towards the beginning of the month. As I write, he is still unemployed, and looking for opportunities.

On the flip side, we were refunded a large part of a deposit we had put on venue for a big event, which makes up most of the $891 reimbursement income. This was a really big win – this deposit was supposed to be completely non-refundable, but we negotiated with the venue, and got some of it back. The rest of our reimbursement income was from clothing that I sent back due to sizing.

Once again, the $10 of interest income came from our high interest TFSAs at Tangerine, and $50 came from renting out our parking space to a neighbour every month.

Expenses

| Mortgage | $2,930 |

| Groceries | $995 |

| Strata Special Levy | $918 |

| Sports | $691 |

| Strata Fees | $504 |

| Personal Care | $341 |

| Property Tax | $228 |

| Eating or Drinking Out | $227 |

| Homewares | $218 |

| Liquor | $171 |

| Tech Savings | $100 |

| Public Transit | $95 |

| Internet | $87 |

| Electricity | $83 |

| Password Security | $73 |

| Cellphones | $47 |

| Entertainment | $39 |

| Clothing | $37 |

| Home Insurance | $34 |

| Charity Donation | $32 |

| Apple Music Subscription | $17 |

| Adobe Subscription | $15 |

| Netflix | $14 |

| Flowers | $13 |

| Dentist | $12 |

| Disney+ | $10 |

| Education | $7 |

| Parking | $4 |

| Online Storage | $3 |

| ATM fees | $2 |

| Postage | $2 |

| TOTAL | $7,949 |

Our spending in October felt massive, as we shouldered some big bills and made some preparations for the winter.

Let’s start with the groceries, which we spent more on than usual at $995. On the one hand, we started trying recipes from Budget Bytes, which a guest mentioned in passing on the ChooseFI podcast. These recipes were tasty and I think, cheap.

On the other hand, we also had to cater for Canadian Thanksgiving with our bubble and Oktoberfest with some socially distanced friends, and fund our quarterly trip to Costco. The fight to bring down our grocery spending continues…

Next, that strata special levy. Another annoying thing about living in a strata is that you can be asked to pay a “special levy” – an extra contribution on top of strata fees. This is usually to fund a particularly big job, e.g. rewiring the building, replacing the windows, or installing new elevators.

In this case, we have to pay $918 in both October and November as a special levy to pay for building envelope work needed. I will be so happy once both instalments are done with, as it really eats up a huge chunk of the budget!

So, onto some of our winter preparations. Under Sports expenditure, we decided to spend $691 on Silver passes to Cypress Mountain. We got a discount through a friend’s group purchase, but it was still a lot of money.

Our thinking is that it will be a good way to see friends outdoors during a winter full of Covid. Plus, when Cypress publishes their opening plan, if we’re unhappy with it, we’re allowed to defer the pass until next season. We’ll see how it goes…

Also part of our winter preparations was some personal care spending that we’ll call “adult entertainment.” This was the majority of the $341 labelled personal care here. The rest was some bulk bottles of shampoo and conditioner that should keep me going for a while.

Lastly in our winter preparation efforts comes homewares. This month, we bought a standing desk for Tim’s workstation, should he need to work from home once he finds a job. This particular model is supposed to cost $500 new, but he picked one up for $175 on Facebook Marketplace. That made up the majority of our homewares spending in October.

Picking out some other expenditure of note, our public transit spending may look big, but actually, we haven’t been riding the bus every day or anything. We spent $95 loading up our BC Ferries Experience Card so we get discounts on ferry trips. We already saved $30 on a ferry journey in October by using the pre-loaded card to pay for our tickets. I highly recommend it!

Meanwhile, password security is important to us and this month, our annual LastPass subscription of $73 came around. Happy to pay it – definitely worth every cent.

Our entertainment spending this month was on two movies – Tenet, at the theatre, and Bill & Ted Face The Music, at home. In the case of Tenet, it was rather surreal to go to the movies for the first time in months, but there was hardly anyone there and we felt very safe. Both movies were most excellent by the way!

You’ll see our dentist expenditure was only $12. How is this possible? I finally got extended benefits! We also had a few prescriptions to collect this month – but I didn’t have to pay for any of them, so they don’t even feature here. I feel so lucky to have this job.

Overall, despite the benefits, our spending in October was even higher than September at $7,949.

FIRE Savings

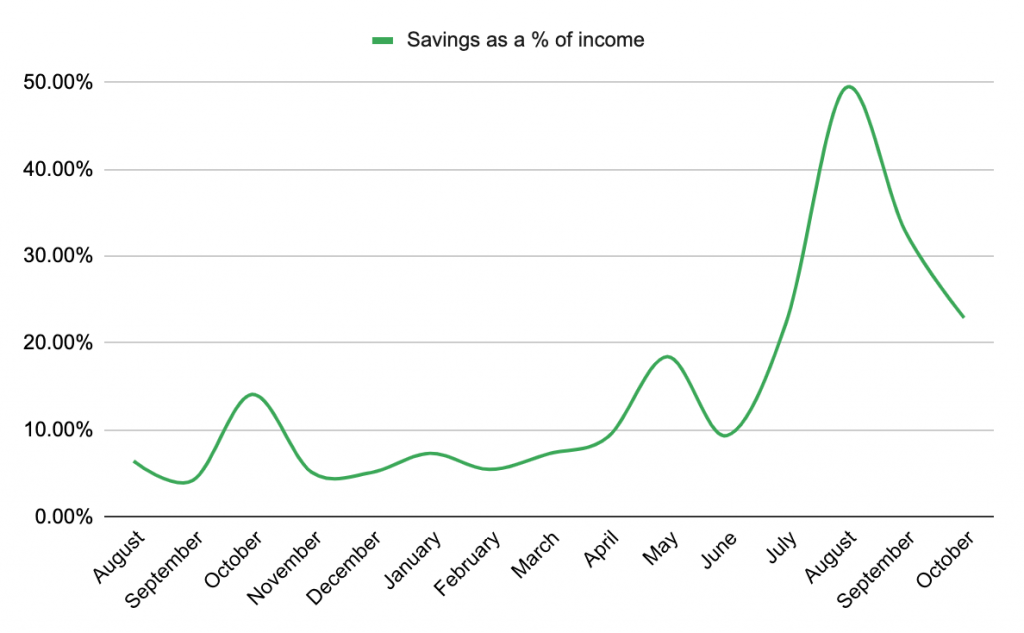

After balancing our budget, we figured that this month, we had $2,400 spare to put towards our FIRE savings. This is less than September, but still a fair 22% of this month’s income.

The whole lot all went straight into our RRSPs at Questrade and brought our total FIRE savings to $218,964 as of November 1. (Yes, that’s down from last month, because the markets took a dive during Covid’s second wave. We see it as a sale, where we can buy our ETFs for less than usual.)

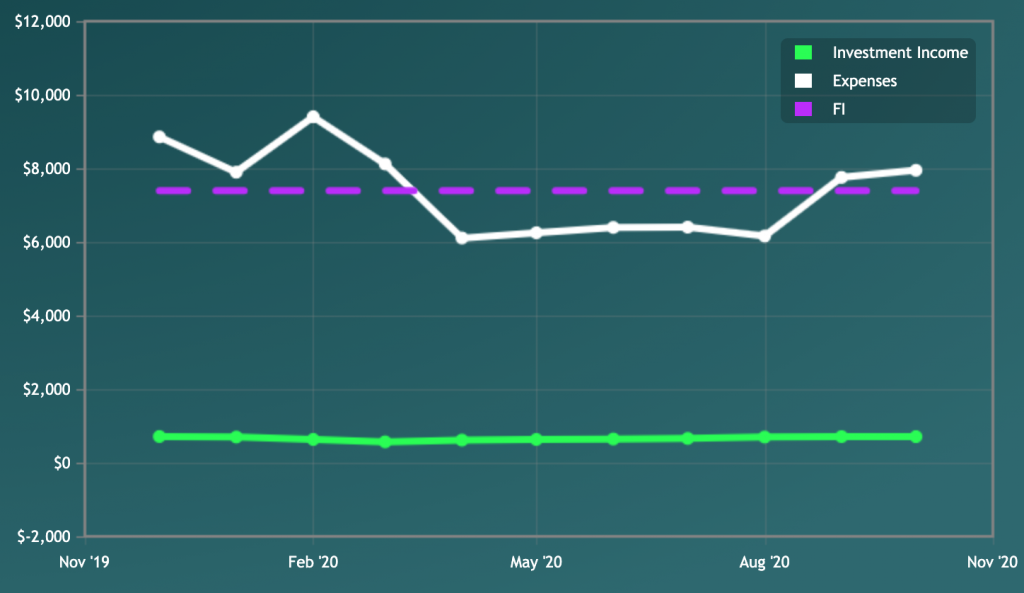

Plugging all these numbers into the Mad Fientist‘s FI Laboratory gives me the below graph, and the expected FI date of February 2043.

(Sure, I know it’s not the whole picture, but I like to input the numbers and see the difference anyway.)

According to the FI Laboratory, that’s the same FI date as it gave us last month, so we’ve moved no closer to FI in October, but at least we haven’t moved further away.

On a personal note, we are struggling with the challenges the pandemic is bringing this fall and winter, the isolation of some of our friends, and just the general darkness and cold weather.

But we are doing our best to look forward, stay in touch with friends, either as part of our Safe Six, or in a physically distanced way, and find ways to stay positive in the darkness.

Unfortunately, financially, we expect Tim to be out of work for the rest of the year now, which will mean we are drawing on our emergency funds in November. But we’re thankful we’ve got those funds to fall back on, and that I managed to find a full-time, reasonably paid job this year.

That’s all from me this month. I hope you made it through October OK.

I’m Daisy, the writer behind Fire by the Sea, my blog all about seeking financial independence in Vancouver, Canada. I love hiking, snowboarding, travelling, and cheese. You can read more about me, and my partner Tim, right here.

Contact me at daisy@firebythesea.ca.