Let’s start with a confession – May was an extremely spendy month. The worst we’ve had in ages actually. Of course, there are reasons for this, but… we can’t let it happen again!

With Covid restrictions loosened more than ever since the start of the pandemic, we now find ourselves both spending money on staying home (where we are still working) and going out.

Let me take you through the numbers and we’ll see how it all went down.

Income

| Paycheques | $10,399 |

| Smith Manoeuvre Dividends | $244 |

| Reimbursement | $183 |

| Parking Spot Rent | $50 |

| Credit Card Cashback | $37 |

| TOTAL | $10,912 |

This month, I got a small annual pay rise. Although it isn’t a huge amount, so won’t really be impacting any FIRE maths, it was still a really nice surprise! Meanwhile, Tim did a bit of overtime, so his paycheque was slightly more than usual too.

Apart from that, there isn’t too much to report in terms of income. The reimbursements here were for physio sessions claimed through our extended benefits.

However, our Smith Manoeuvre efforts are coming along nicely. Our dividends totalled $244 for May! We began the Smith Manoeuvre on January 1, 2021, investing the money from the HELOC portion of our readvanceable mortgage into a portfolio of Canadian dividend stocks.

As we receive dividends from this portfolio, we use them to pre-pay our mortgage, and as you’ll see below, we continued to do that in May. As we keep investing in this portfolio through the Smith Manoeuvre, our dividends will increase too. Ultimately the goal is to pay off our mortgage quicker.

Expenses

| Mortgage | $2,728 |

| Furniture | $2,000 |

| Groceries | $988 |

| Strata Fees | $504 |

| Eating or Drinking Out | $407 |

| Homewares | $392 |

| Gifts | $312 |

| Sports | $307 |

| Tech Savings | $300 |

| Liquor | $255 |

| Smith Manoeuvre Mortgage Pre-Payment | $244 |

| Property Tax | $228 |

| Medical Expenses | $170 |

| Clothing | $145 |

| Pets | $121 |

| Dry cleaners | $104 |

| Internet | $87 |

| Office Supplies | $78 |

| Charity Donation | $75 |

| Cellphones | $72 |

| RunKeeper | $62 |

| Miscellaneous | $52 |

| Home Insurance | $41 |

| Web hosting | $25 |

| Apple Music Subscription | $17 |

| Netflix | $16 |

| Apple Fitness+ Subscription | $15 |

| Adobe Subscription | $15 |

| Disney+ | $10 |

| Education | $4 |

| Online Storage | $4 |

| TOTAL | $9,778 |

Wow that feels like one of my longest spending lists ever. Time for the confessions to flow…

One major reason for our high spending this month is the furniture expenditure of $2,000, which is actually a part payment for bedroom furniture that we bought earlier in the year. Although we paid for everything upfront, for budgeting purposes, we spread the cost over our March, April and May budgets. I am so glad to be done with that now!

But there was plenty more spending on top of that. Our grocery expenditure was much higher than normal, and we also spent more on eating and drinking out. I think this was the result of initially having to hunker down at stay at home more under strict new rules, followed by the relaxation of these restrictions to allow more meeting up with friends and eating out.

The homewares purchases were a buckwheat hull pillow for Tim, after mine proved popular back in April, and a real linen fitted sheet. Over the last couple of months, I’ve been trying to find items that you buy for life (or at least a long time), and this had led me to the buckwheat hull pillows and the real linen. So far, despite having spent $200+ on the linen sheet, I’m not convinced. It has already started pilling, even though we are following the producer’s instructions for care.

It was a pricy month for gifts too, due to a sibling’s birthday and a family friend who fell ill. Thankfully, our friend is much better, and we were happy to pamper her while she recovered.

Our high sports spending was due to the need to replace running shoes and shorts. Our medical costs were physio sessions related to running injuries, probably caused by shoes we should have replaced earlier. Lesson learned.

Finally, clothing costs were simply the tailoring of a suit that Tim already owned, but which was now too large for him. We consider it an investment in the longevity of the suit.

Overall though, we spent way too much money! Hopefully, we don’t repeat that any time soon.

FIRE Savings

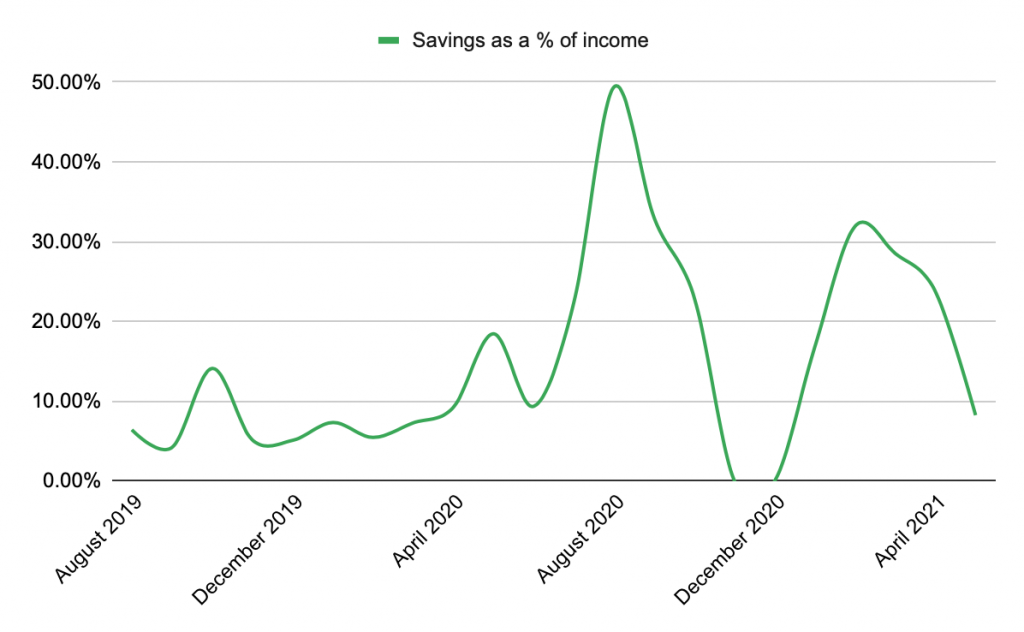

After balancing our budget, we had $900 left to put towards our FIRE savings. This is the lowest percentage of our income we have saved in ages:

In addition, the total value of our FIRE fund value increased in the last month, rising to $257,673 as of May 31.

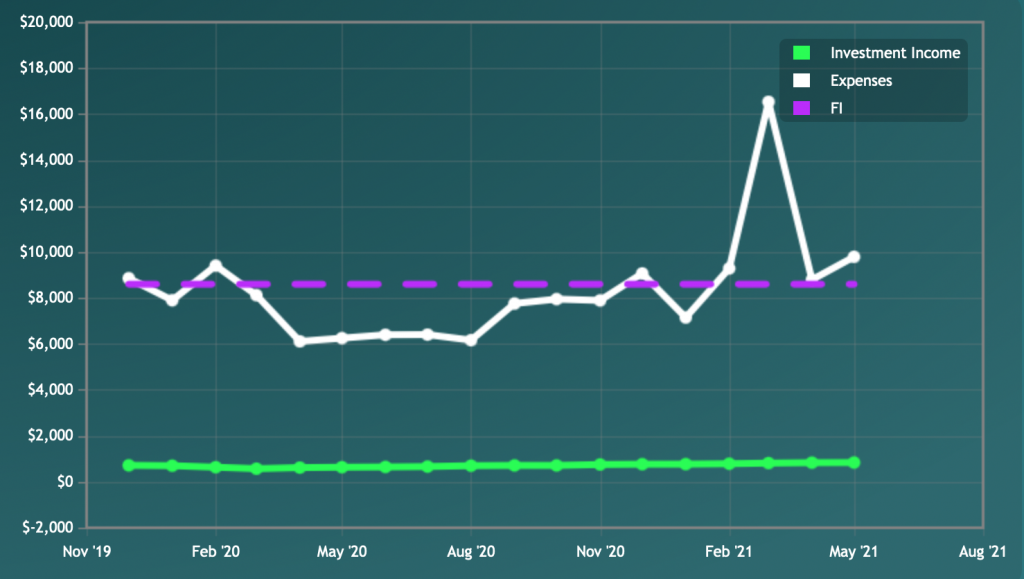

Plugging all these numbers into the Mad Fientist‘s FI Laboratory gives me the below graph, and the expected FI date of June 2042.

(Sure, I know it’s not the whole picture, but I like to input the numbers and see the progress.)

That is really depressing, because according to FI Laboratory, we’ve got several months further away from our FIRE goal. Hopefully we can remedy that in June! Onwards and upwards!

I’m Daisy, the writer behind Fire by the Sea, my blog all about seeking financial independence in Vancouver, Canada. I love hiking, snowboarding, travelling, and cheese. You can read more about me, and my partner Tim, right here.

Contact me at daisy@firebythesea.ca.