Spring is here! In beautiful BC, March has brought high numbers of COVID-19 cases, but also a lot of vaccinations, sunshine, and chances to spend time with friends outdoors.

My broken wrist is healing well. I finally got my cast off and am enjoying having the freedom to wear whatever clothes I like, wash my arm in the shower, and just generally be useful again!

Financially, March was also a big month for lots of reasons, so let’s see how it went.

Income

| Paycheques | $9,559 |

| Reimbursement | $7,198 |

| Tax Refund | $6,577 |

| Credit Card Cashback | $174 |

| Parking Spot Rent | $50 |

| Smith Manoeuvre Dividends | $24 |

| Interest Income | $2 |

| TOTAL | $23,584 |

This month, our paycheques totalled $9,559, but the real story is in the other income we picked up, including reimbursements, tax refunds, and our first Smith Manoeuvre dividends.

First, those reimbursements, hauling in $7,198. This is largely one particular refunds – for a cruise that we had booked pre-COVID, using money from our TFSAs. The cruise was cancelled really early in the pandemic, but it has taken us a year of fighting for our money back, eventually launching a credit card dispute. Needless to say, we won’t be booking a cruise ever again.

Second, our tax refunds, which totalled $6,577 this year, mostly because of all the contributions we made to our RRSPs in 2020. Worth it on so many levels!

Third, those Smith Manoeuvre dividends, totalling $24 for March. It’s not much, but it’s a start. We began the Smith Manoeuvre on January 1, 2021, investing the money from the HELOC portion of our readvanceable mortgage into a portfolio of Canadian dividend stocks.

As we receive dividends from this portfolio, we will use them to pre-pay our mortgage. The same goes for our tax refunds. And as we keep investing in this portfolio through the Smith Manoeuvre, our dividends will increase too. Ultimately the goal is to pay our mortgage off much quicker.

Expenses

| Smith Manoeuvre Mortgage Pre-Payment | $6,601 |

| Mortgage | $2,728 |

| Furniture | $2,726 |

| Groceries | $989 |

| Miscellaneous | $509 |

| Strata Fees | $504 |

| Sports | $403 |

| Eating or Drinking Out | $319 |

| Tech Savings | $300 |

| Liquor | $281 |

| Property Tax | $228 |

| Medical Expenses | $196 |

| Home Maintenance | $148 |

| Transport | $123 |

| Wine Club Subscription | $95 |

| Internet | $87 |

| Cellphones | $83 |

| Pets | $48 |

| Home Insurance | $41 |

| Homewares | $25 |

| Charity Donation | $20 |

| Apple Music Subscription | $17 |

| Apple Fitness+ Subscription | $15 |

| Adobe Subscription | $15 |

| Netflix | $15 |

| Disney+ | $10 |

| Education | $4 |

| Online Storage | $4 |

| TOTAL | $16,534 |

Our spending this month was really high, although there a few good reasons for that.

Starting at the top with our Smith Manoeuvre Mortgage Pre-Payment of $6,601 – this is a payment we will hopefully be making every month from now on, although for differing amounts, since it is a total of any tax refunds or dividends we receive from our Smith Manoeuvre portfolio. Obviously this month, we got our tax refund after submitting our taxes early, so this added hugely to the amount we could pre-pay towards our mortgage.

That furniture expenditure of $2,726 is actually a part payment for bedroom furniture, including a bed, mattress, bedside tables, and a dresser. We have been using second/third hand bedroom furniture for a decade and when the time came to replace the mattress (the only thing we did buy new 10 years ago), we decided to bite the bullet and just invest in some really high-quality pieces. Although we paid upfront for everything, for budgeting purposes, we are spreading the cost over the April and May budgets too.

At $989, groceries were a little higher than normal, mainly because we took a trip to Costco to stock up. But what of that Miscellaneous category worth $509? Well, this was a few real one-off payments, including passport renewal and postage fees, TurboTax tax return fees, and the cost of a new case for my phone.

Sports was also a high spending category this month at $403, mainly because we invested in some new running shoes and signed up for an actual in-person race happening (hopefully) in the summer. It will be worth the unbelievably steep entry fees, just to run in a proper race again.

And, as you would expect now that we are allowed to socialize with people in gardens, beaches, and parks, our eating/drinking out and liquor store spending has gone up slightly from last month! But seeing our friends has been totally worth it, of course.

Hopefully that explains how our spending was so big! Although we spent a lot on furniture, sports, and those miscellaneous items, I think these things will either last a long time, or serve to give us some memorable experiences.

FIRE Savings

After balancing our budget, we obviously had a big chunk of change spare, due to that cruise reimbursement ($6,726). Since that money was originally taken from our TFSAs when we paid for the trip, we decided to put it right back, to save and invest it as we should have been already!

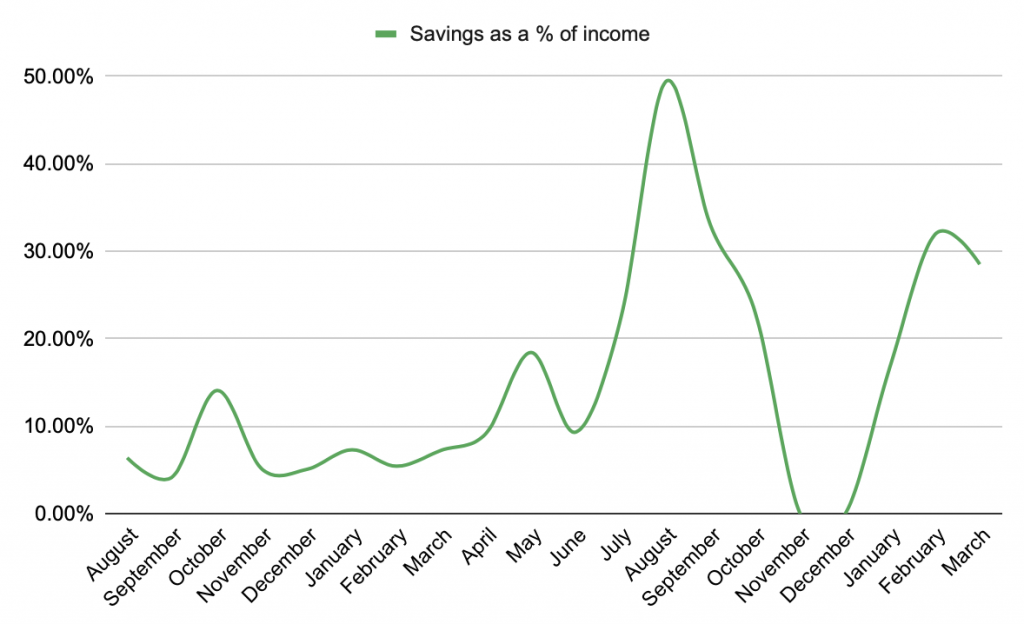

This has kept our savings as a percentage of our income hovering around 30%:

Our total FIRE fund value also increased in the last month, rising to $250,415 as of March 31.

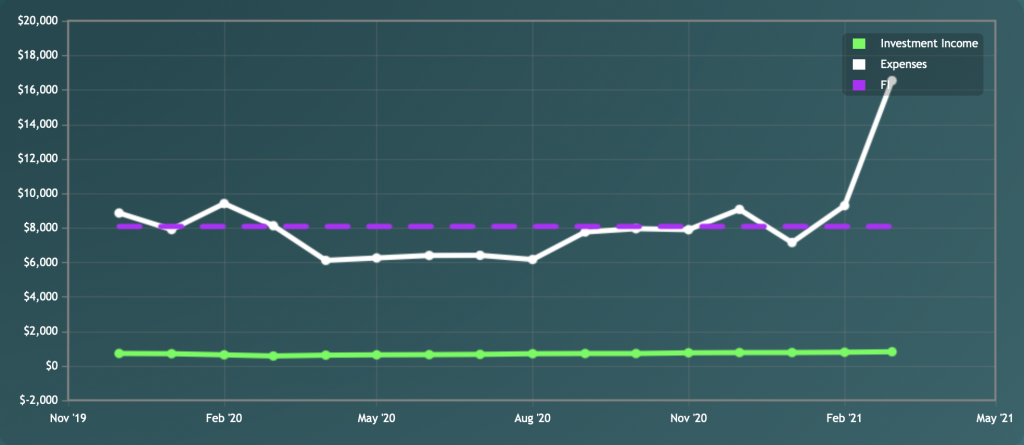

Plugging all these numbers into the Mad Fientist‘s FI Laboratory gives me the below graph, and the expected FI date of Nov 2041.

(Sure, I know it’s not the whole picture, but I like to input the numbers and see the progress.)

According to the FI Laboratory, that FI date is several months closer than the one we got last month (May 2042), which reassures me we are making progress, slowly but surely.

Now, I’m just looking forward to April – along with lots of sunshine, friends, and outdoor time. I hope you have a great start to spring too!

I’m Daisy, the writer behind Fire by the Sea, my blog all about seeking financial independence in Vancouver, Canada. I love hiking, snowboarding, travelling, and cheese. You can read more about me, and my partner Tim, right here.

Contact me at daisy@firebythesea.ca.