What a start to the New Year. Just as we were all breathing a sigh of relief at the end of 2020, the US seemed to go crazy as a belfry of bats and scary as all hell.

Thankfully, they seemed to have turned a corner, and we are extremely relieved up here in Canada. But it was pretty frightening for a while there.

And it wasn’t just events in the US that depressed us in January. We both really struggled with our mental health, with down days turning into down weeks.

But, as I write now, we too seem to have turned a corner, although it’s hard to explain why. Luckily, we are here to support each other and get through this tough time together.

Having said all that – this is a blog about finances. So let’s see what we achieved financially this month.

Income

| Paycheques | $7,464 |

| Employment Insurance | $1,032 |

| Parking Spot Rent | $50 |

| Freelancing | $153 |

| Reimbursement | $192 |

| Credit Card Cashback | $25 |

| Interest Income | $2 |

| TOTAL | $8,918 |

This month brought a new job for Tim, which means our paycheques are back on track, bringing in $7,464, and we can leave our emergency savings alone for a while! These paycheques got a $1,032 boost from an outstanding EI payment relating to Tim’s unemployment in December.

As usual, $50 came from renting out our parking space to a neighbour every month. Tim also received $153 royalties from an online video course he made a while ago.

The $192 of reimbursements came from medical expenses that we then claimed back through our benefits, which we now both have through work. I’ve decided to start tracking these – and the expenses that go with them – so we can get an idea of how much we spend on this category.

Plus there was a little bit of interest income ($2) and credit card cashback ($25).

Expenses

| Mortgage | $2,728 |

| Groceries | $1,282 |

| Home Maintenance | $641 |

| Strata Fees | $504 |

| Gifts | $386 |

| Tech Savings | $300 |

| Medical Expenses | $281 |

| Property Tax | $228 |

| Liquor | $196 |

| Eating or Drinking Out | $176 |

| Transport | $113 |

| Internet | $87 |

| Cellphones | $46 |

| Pets | $44 |

| Home Insurance | $41 |

| Charity Donation | $20 |

| Apple Music Subscription | $17 |

| Adobe Subscription | $15 |

| Netflix | $14 |

| Disney+ | $10 |

| Entertainment | $6 |

| Wire fees | $5 |

| Education | $4 |

| Online Storage | $3 |

| TOTAL | $7,147 |

After a very spendy December, we made an effort to knuckle down and get back to basics in January. Also, our mortgage payment was reduced, after we transferred to a different lender last month. Our mortgage payments are now $2,728, which has freed up an extra $200.

We are putting that $200 into our tech fund, along with the $100/month we were originally saving, to help pay for future tech expenses (cellphones, computers, headphones etc.) that will inevitably arise. We realized $100/month was not enough, so have upped these monthly savings to $300.

Our grocery bill came to $1,282 this month, because we had a chance to go to Costco, so we took it and stocked up on $326 of canned tomatoes, multi-pack pasta, kitchen roll, toilet paper, jars of artichokes, and parmesan cheese to name just a few of the items we purchased.

There was some unexpected big spending in the Home Maintenance category this month, as we had to get our fridge repaired. This took a couple of technician visits and some new parts, which came to $636. At times like this, I remember what the ChooseFI guys like to say: “Life is lumpy.”

On the flip side, at $196 we spent much less on liquor this month, because we both felt so down, we decided it would not be a good idea to drink much alcohol, which could potentially bring us down further. This obviously had the added bonus of saving us some money.

Having said that, we did have a couple of notable exceptions, when we let loose and actually went to eat or drink out at places on the spur of the moment, at a cost of $176. This was the first time we had done this in months and it was both an unnerving and invigorating experience.

As I mentioned above, I decided to start tracking our medical expenses, even though it all gets reimbursed by our benefits. This will help us better estimate our true expenses, for when we no longer have those benefits. This month we spent $281, mostly on physiotherapy.

Finally, our friendship group had quite a few birthdays (including mine) this month, which is why the Gift spending is so big at $386! We did our best to celebrate virtually, and tried to share thoughtful gifts that would be a ray of light in the darkness for us all this month.

FIRE Savings

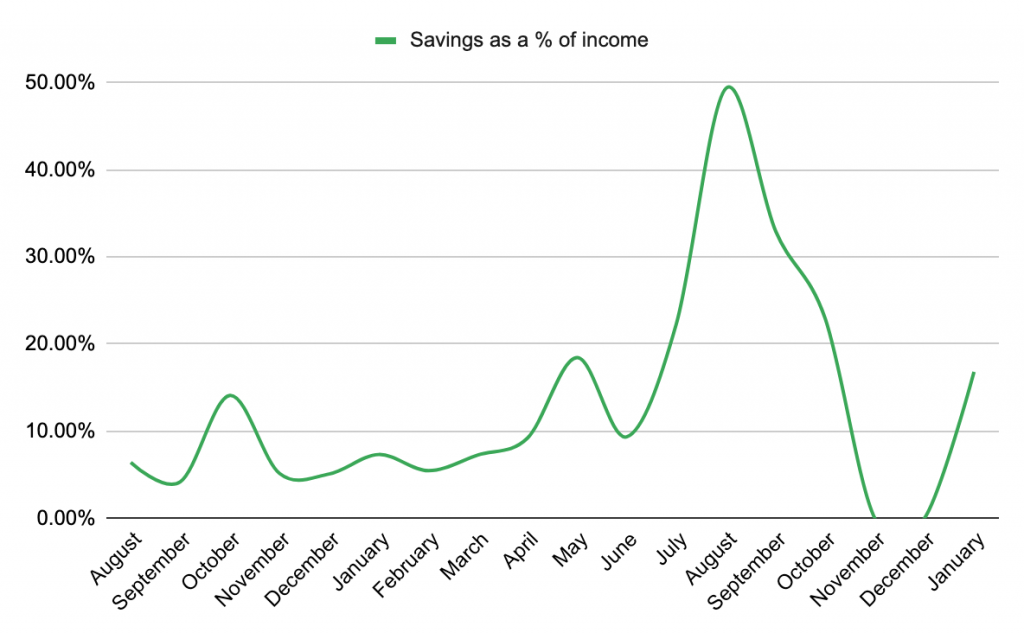

After balancing our budget, we realized we had $1,500 left over to save and invest this month – which means the graph is looking happier now!

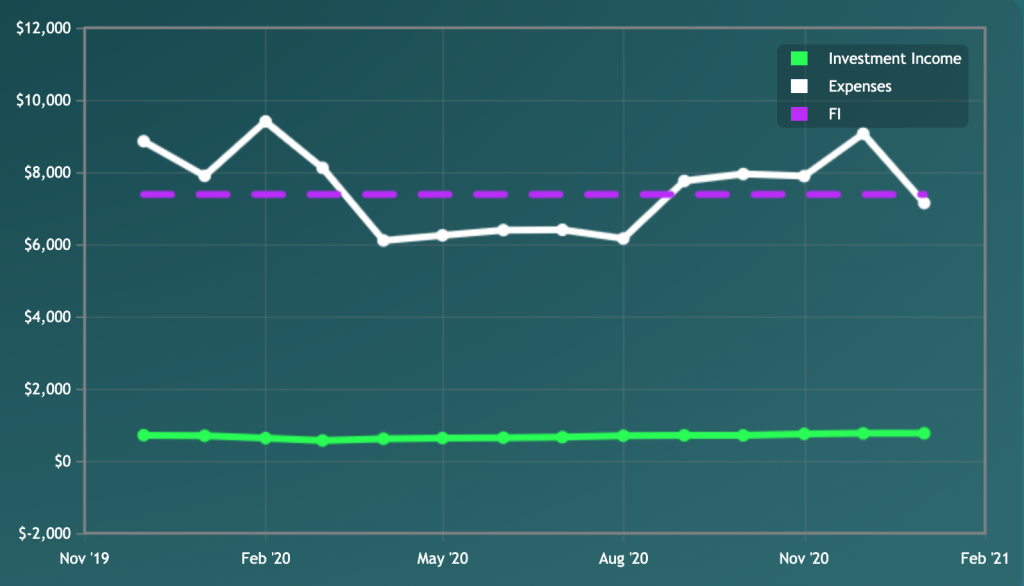

Our total FIRE fund value has increased a little in the last month, rising to $236,419 as of January 31. (This is before our $1500 contribution, which hasn’t reached our Questrade accounts yet.)

Plugging all these numbers into the Mad Fientist‘s FI Laboratory gives me the below graph, and the expected FI date of April 2043.

(Sure, I know it’s not the whole picture, but I like to input the numbers and see the progress.)

According to the FI Laboratory, that FI date is four months closer than the one we got last month, which shows we are already starting to make up for time lost during Tim’s unemployment.

On that positive note, I’ll sign off. I hope you made it through January OK – and here’s hoping for good things in February!

I’m Daisy, the writer behind Fire by the Sea, my blog all about seeking financial independence in Vancouver, Canada. I love hiking, snowboarding, travelling, and cheese. You can read more about me, and my partner Tim, right here.

Contact me at daisy@firebythesea.ca.