Well, we made it through February! What a month. Here in BC, we’re in our fifth month of Covid restrictions. And then I went and broke my wrist in a snowboarding collision.

This injury was a total shock to the system, especially since it was the result of someone else losing control and crashing into me from behind. I’ve never broken anything before.

It was also a great lesson in how it pays to hope for the best, but prepare for the worst. Because you never know when life is going to totally smash into the back of you.

This injury had a few unexpected effects on our budget, as I’ll explain below, but I think the actions we’ve taken since pursuing FIRE made it easier than it could otherwise have been.

Here’s what happened financially in February, while I was busy growing new bones.

Income

| Paycheques | $10,045 |

| Parking Spot Rent | $50 |

| Reimbursement | $817 |

| Credit Card Cashback | $52 |

| Interest Income | $2 |

| TOTAL | $10,966 |

This month, our earnings were back up to full strength, this being the first full month of us both receiving paycheques since October 2020. This meant we pulled in $10,045.

It’s worth noting, this would not have been possible without paid sick leave, which I have had to use a lot since breaking my wrist. I’m very grateful to be working somewhere which provides this.

Moving on, as usual, $50 came from renting out our parking space to a neighbour every month.

The $817 of reimbursements came mainly from two sources. Firstly, medical expenses that we incurred, some of which were the result of my broken wrist. This is the first place our FIRE plan comes in to help us out with injury.

When I decided to look for a full-time job last year to increase my income, I made a point of only applying to jobs that offered benefits. It took many months, but I was eventually successful. Now, thanks to the benefits provided by my job, these medical expenses could now be reimbursed.

The second, biggest part of the reimbursements this month came from a Vrbo booking we made before the pandemic for April 2020. They finally refunded our $512 payment!

Plus there was a little bit of interest income ($2) and credit card cashback ($52).

Expenses

| Mortgage | $2,728 |

| Life Insurance | $1,698 |

| Clothes | $860 |

| Groceries | $652 |

| Strata Fees | $504 |

| Sporting Equipment | $448 |

| Tech Savings | $300 |

| Liquor | $252 |

| Medical Expenses | $231 |

| Property Tax | $228 |

| Eating or Drinking Out | $209 |

| Electricity | $197 |

| Education | $183 |

| Transport | $177 |

| Gifts | $100 |

| Fitness | $93 |

| Internet | $87 |

| Homewares | $56 |

| VPN | $52 |

| Home Insurance | $41 |

| Entertainment | $32 |

| Adobe Subscription | $29 |

| Postage | $26 |

| Pets | $23 |

| Charity Donation | $20 |

| Cellphones | $13 |

| Apple Music Subscription | $17 |

| Netflix | $15 |

| Disney+ | $10 |

| Online Storage | $3 |

| TOTAL | $9,284 |

This month’s spending was pretty high, because it came time to pay our annual term life insurance premiums if $1,698. We pay annually because it costs less than paying monthly.

The next point of note is obviously that massive clothing spend, at $860, which is entirely unlike me. This was mostly swimwear that I bought online from Venus, to replace my existing bikini, which was several years old and falling apart. Unsure as to the correct size, I bought all possible permutations, then sent back what didn’t fit for a refund. It was an easy process and I’m expecting the sizeable reimbursement in March.

Next up is our grocery bill of $652, which was much lower than normal. This is where our FIRE plan came in to help us with my injury again. Since pursuing FIRE, we cook at home and freeze the leftovers. This means our freezer is usually packed with ready made dinners.

Now that I’m stuck in a cast and unable to do my share of the cooking, supplying all the meals has fallen to Tim, which has been pretty overwhelming. To alleviate that stress, we began raiding our freezer stash a couple of times a week. This gave Tim some breathing space, and as an added side effect, meant we spent less on ingredients for the dishes he did decide to cook from fresh.

Ironically, the $448 sporting equipment expenditure was new snowboard boots, which I bought the day before my injury. My first new pair in 10 years. Oh well – they’ll do for next season!

As usual, we continued to save $300 in a high interest TFSA, for future tech purchases. So far we’ve managed to accumulate $1,022 in there, which feels pretty good.

We spent $209 on Eating and Drinking Out this month. This was all takeout, to simply relieve the need for Tim to cook every single night, while I was out of action due to my broken wrist.

Education spending continued to include subscriptions to the courses Tim started taking while he was unemployed. He wants to hold onto those until he has time to complete them.

Transport costs of $177 included hiring an EVO to go snowboarding a few times… and then to the emergency room. Haven’t had a need to hire a car since then!

We spent $93 on fitness this month – this was Tim’s annual Strava membership and his new Apple Fitness subscription, which he uses almost every day. Both these things have really helped him survive the pandemic, so we think it is good value for money.

Overall, I was pretty happy with how our spending went in February. And our FIRE preparations came through for us when we were unable to cook, and had some medical expenses to claim.

FIRE Savings

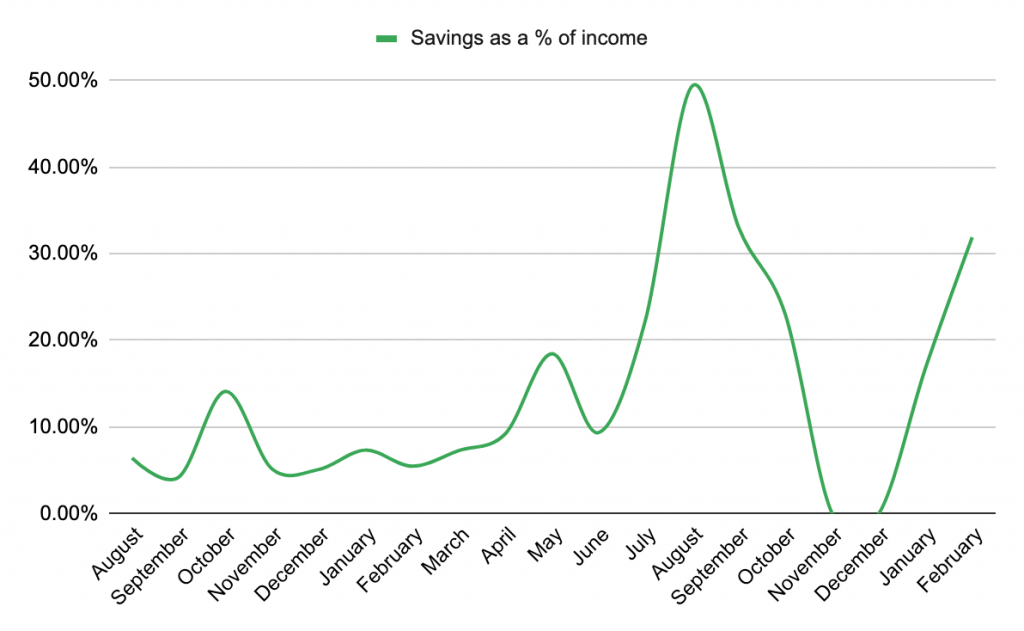

After balancing our budget, we had $3,500 left over to save and invest this month. This is certainly sending this graph in the right direction, and I feel like we’re getting back on track!

Our total FIRE fund value also increased in the last month, rising to $242,066 as of February 28.

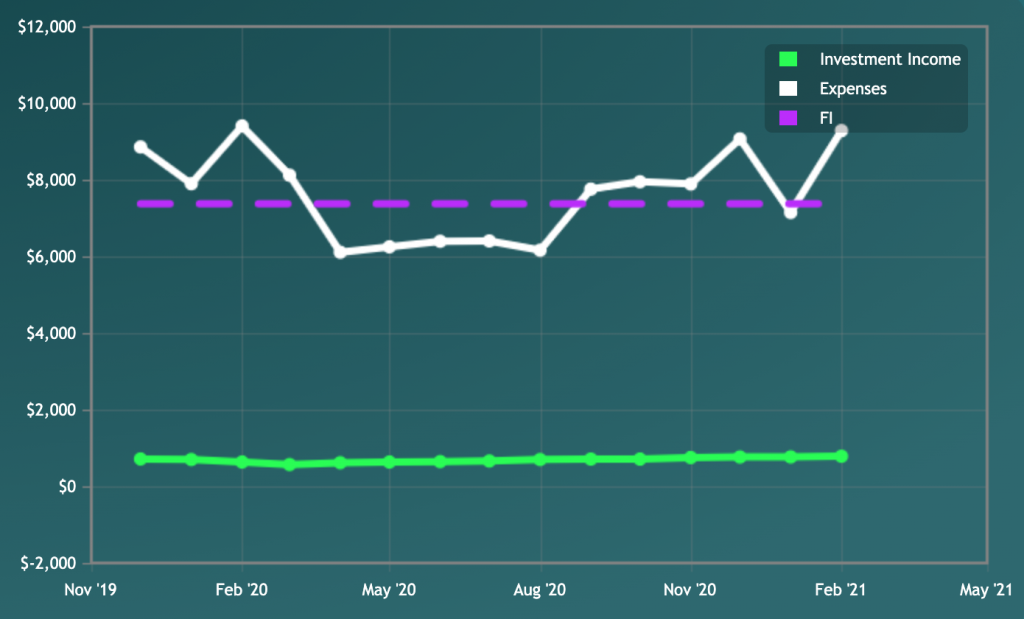

Plugging all these numbers into the Mad Fientist‘s FI Laboratory gives me the below graph, and the expected FI date of May 2042.

(Sure, I know it’s not the whole picture, but I like to input the numbers and see the progress.)

According to the FI Laboratory, that FI date is almost a year closer than the one we got last month, which makes me excited to keep making more progress next month.

I’m also looking forward to March because the weather will be warmer, the sun will be shining, and I will finally get to take my cast off and start my rehab. Wish me luck!

I’m Daisy, the writer behind Fire by the Sea, my blog all about seeking financial independence in Vancouver, Canada. I love hiking, snowboarding, travelling, and cheese. You can read more about me, and my partner Tim, right here.

Contact me at daisy@firebythesea.ca.