August is done! Here in Vancouver, Tim faced the realities of office life during a pandemic, I continued in my new position working from home, and we both enjoyed time with friends, camping and hiking in British Columbia.

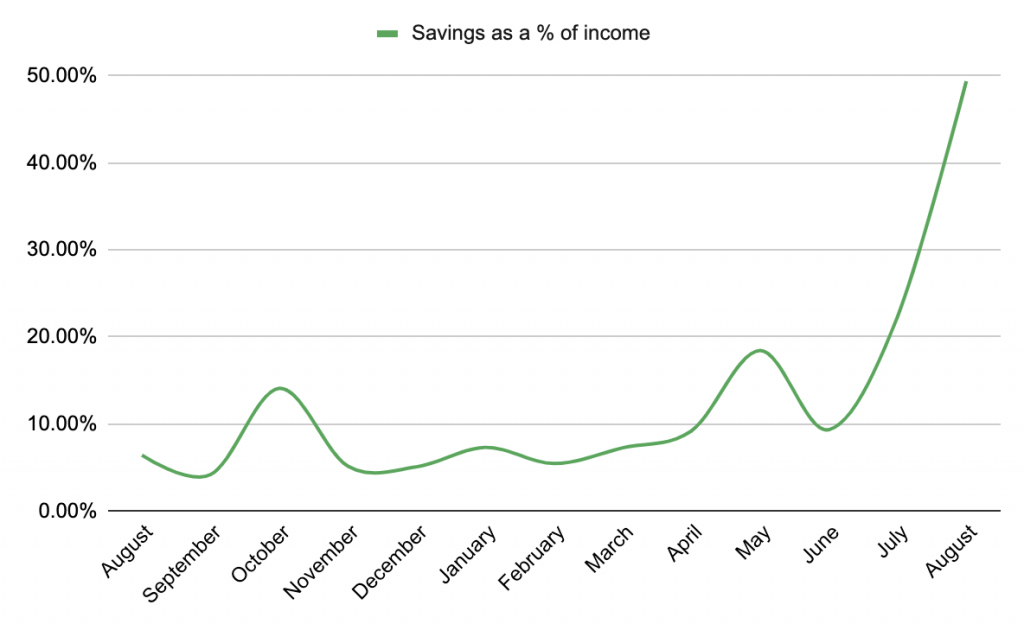

Financially, after much uncertainty this year, I’m happy to say that we actually earned much more than expected in August! This meant we could put almost half our income this month towards FIRE – more than ever before.

Here’s how it all shakes down:

Income

| Paycheques | $11,581 |

| Freelancing | $700 |

| Reimbursement | $186 |

| Credit Card Cashback | $183 |

| Sold Stuff Online | $128 |

| Referral Bonus | $100 |

| Cryptocurrency | $76 |

| Parking Spot Rent | $50 |

| Interest Income | $18 |

| TOTAL | $13,022 |

This month, our paycheque income was a lot larger than normal, due to Tim doing a crazy amount of paid overtime. We’re talking about overtime until 3 am here, folks.

On the one hand, this kind of financial boost is really, really welcome and we feel very lucky to be in this position, especially after Tim’s earlier periods of unemployment due to the pandemic. On the other hand, overtime sucks.

Still, knowing that every cent of that extra money gets us closer to FIRE certainly gives us a sense of purpose when we’re tired and grouchy. Plus, Tim got paid $700 for some freelance work he did earlier this year, which was a nice bonus.

At $186, the reimbursement category was very high this month, because we made some purchases for the home office and actual office, which didn’t work out and had to be sent back.

As ever, I try to declutter and sell things online when I can, because every little helps. This month, I sold a camping table, a sleeping bag, and some computer memory, for a total of $128 – not bad. And, since we sold our car earlier this year, we continue to rent out our parking space to a neighbour for $50 every month.

Free money highlights:

Our credit cards just keep giving cash back, specifically the Scotia Momentum VISA Infinite card, the Rogers World Elite Mastercard, and the American Express Simply Cash card, which all paid out $183 this month. I am so happy Tim got into credit card churning!

We received $100 from referral bonuses from Tangerine. Earlier in the year, I opened a Tangerine account to take advantage of their promotional interest rate offer. When I did that, like every Tangerine customer, I was given a referral code.

Tim then used this code to set up a new account for himself – and this month, as a reward, we got a free $50 each. We also continue to enjoy Tangerine’s promotional interest rate, earning $18 in interest this month.

Our cryptocurrency income is a combination of free crypto given away on a messaging app a while ago, and crypto rewards offered by Coinbase for taking free online tutorials. Little by little it adds up, then we consolidate it, and withdraw some as dollars. This month, that gave us $76.

Overall, income was beyond expectations, at $13,022.

Expenses

| Mortgage | $2,930 |

| Groceries | $754 |

| Strata Fees | $419 |

| Liquor | $307 |

| Clothing | $277 |

| Property Tax | $228 |

| Eating or Drinking Out | $190 |

| Car Rental | $180 |

| Work Equipment | $134 |

| Tech Savings | $100 |

| Home Office | $90 |

| Internet | $87 |

| Bike Equipment | $84 |

| Electricity | $58 |

| Miscellaneous | $56 |

| Camping Fees | $53 |

| Admin Fees | $47 |

| Cellphones | $47 |

| Gas | $44 |

| Home Insurance | $34 |

| Sports | $32 |

| Personal Care | $28 |

| Pet Shop | $26 |

| Transit | $20 |

| Education | $18 |

| Apple Music Subscription | $17 |

| Adobe Subscription | $15 |

| Netflix | $14 |

| Disney+ | $10 |

| Online Storage | $3 |

| TOTAL | $6,246 |

Our spending in August was full of ups, downs, and hopefully optimizations.

On the groceries front, we don’t usually use meal kit services but, this month, we got a couple of free trial weeks of HelloFresh and GoodFood. We signed up, got the free food, then cancelled. Those two free weeks helped keep our grocery costs down.

However, we ended up spending a bit on clothes, a combination of Tim buying summer clothes online in the sales, me buying new work shoes online (didn’t fit, got reimbursed), and me purchasing work clothes from the thrift store.

As BC’s Restart Plan continued, we chose to drink or eat out twice this month. On patios. In the open air. Far away from everyone else. However, the bulk of our Eating or Drinking Out spending came from Tim, who spent $78 on coffee.

Yes – this is the real life latte factor folks!

After going back to work in the office, Tim found there is no longer a shared tea and coffee machine due to Covid. Since he’s a complete tea and coffee addict, he started frequenting the nearby cafes.

However, once he realized how much this spending was adding up, he proactively made a FIRE-proof plan to bring his own tea and coffee to work instead.

Armed with a flask (see Work Equipment spending!), a French press (donated), and Nabob coffee grounds (on offer), he now makes all his own drinks at work and enjoys how much he is saving!

Outside work, we went camping this month with friends. Normally, we would jump in their car, but since they aren’t in our bubble, we felt it was safer to hire our own car instead. This was more expensive, but we believe it was the right thing to do.

If you’re wondering what Tech Savings are… We tend to spend a lot on technology, so every month we save $100 for future tech purchases. That way, the money is already “spent” and we’re not hit with a huge bill when we need a new computer.

Also in the realm of tech, this month, I went on a quest to find the right cable so I could connect an old monitor we had lying around to my new computer in my home office. It took a couple of attempts, and I had to get some purchases refunded, but I found the right one in the end! This saved us spending hundreds of dollars on a second screen for my home office.

Next up, my bike, my main mode of transport. I love my bike, but my old bike helmet, not so much. I have a feeling I got it second hand (not safe, don’t do it) but it was so long ago, I can’t actually remember. At this point, it was stuck together with tape and falling apart (not safe, don’t do it), so I treated myself to a brand new helmet that’s super safe and swanky too!

The education costs are Tim’s. He’s building his “talent stack”, learning some code that will make him more valuable at work. The expenses are a Patreon payment to a teacher and an application that Tim can use to test his coding.

Finally, those admin fees. They were charged by our property management company for giving me Form B documents for our mortgage renewal. Bizarrely, these fees include a photocopying charge, even though it is all digital.

Overall, spending was fairly standard these days at $6,246.

FIRE Savings

After balancing our budget, we figured that this month, we had $6,430 spare to put towards our FIRE savings. This is huge for us, and amounted to 49% of this month’s income.

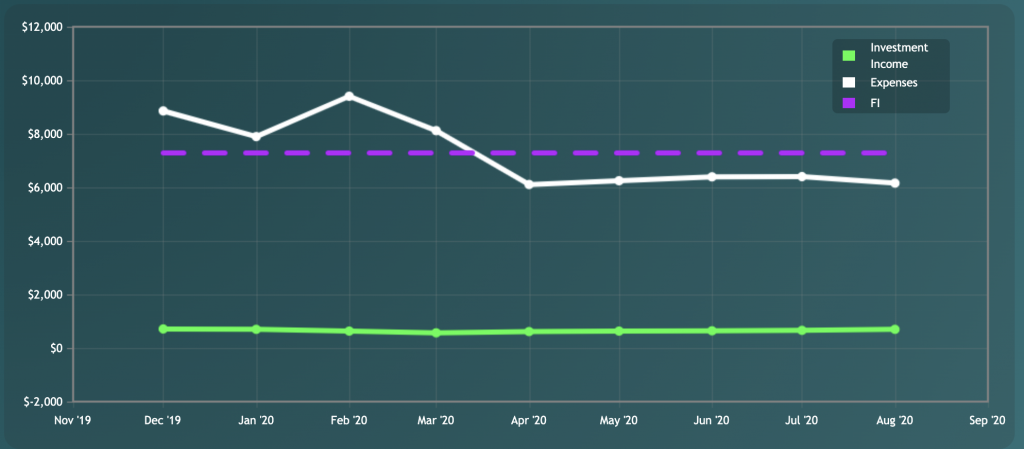

The whole lot all went straight into our RRSPs at Questrade and brought our total FIRE savings to $215,586 as of August 31.

Plugging all these numbers into the Mad Fientist‘s FI Laboratory gives me the below graph, and the expected FI date of November 2043.

(Sure, I know it’s not the whole picture, but I like to input the numbers and see the difference anyway.)

According to the FI Laboratory, we’ve moved four years closer to FI in August. Last month’s estimated FI date was April 2047. That is oversimplifying the journey ahead of us, but it’s satisfying to see progress being made.

On a personal level, we are feeling focused and motivated by our FIRE journey. It helped us build an emergency fund and cash cushion, and put us in a good position, given that Tim might be unemployed again soon. We are feeling cautiously hopeful.

I hope you had some wins in August too. Let me know in the comments below!

I’m Daisy, the writer behind Fire by the Sea, my blog all about seeking financial independence in Vancouver, Canada. I love hiking, snowboarding, travelling, and cheese. You can read more about me, and my partner Tim, right here.

Contact me at daisy@firebythesea.ca.