Well, April seemed to go by in a flash! I was very busy at work, and I only just feel like I’ve emerged from that particular tunnel now, and it’s already halfway through May.

Covid restrictions have also changed. Freedom to hang out with friends outdoors means that whenever it is sunny, we are out every waking hour; when it rains, we pack in the chores.

Financially, I have to confess, April was a spendy month… with lots of refunds. Let’s see if we can make sense of what happened.

Income

| Paycheques | $10,053 |

| Reimbursement | $953 |

| Smith Manoeuvre Dividends | $214 |

| Credit Card Cashback | $155 |

| Parking Spot Rent | $50 |

| Freelancing | $50 |

| Interest Income | $2 |

| TOTAL | $11,477 |

This month, the story is in that reimbursement. You’ll remember that earlier this year we shelled out a fair bit of money for a new mattress? Well, we returned it and got a cheaper one.

Sometimes, the expensive item isn’t always the best. We tried it, but honestly, I could not get a good night’s sleep on it at all! So we went back to our normal style and pocketed the change.

We also got refunds for transport we had booked for a camping trip in May, which got cancelled in April due to new COVID-19 restrictions. No more travel until after the May long weekend.

Meanwhile, our Smith Manoeuvre efforts are also coming along nicely. Our dividends totalled $214 for April! We began the Smith Manoeuvre on January 1, 2021, investing the money from the HELOC portion of our readvanceable mortgage into a portfolio of Canadian dividend stocks.

As we receive dividends from this portfolio, we use them to pre-pay our mortgage. It was super satisfying doing that in April. And as we keep investing in this portfolio through the Smith Manoeuvre, our dividends will increase too. Ultimately the goal is to pay off our mortgage quicker.

Expenses

| Mortgage | $2,728 |

| Furniture | $1,390 |

| Groceries | $693 |

| Clothing | $564 |

| Strata Fees | $504 |

| Eating or Drinking Out | $348 |

| Medical Expenses | $340 |

| Tech Savings | $300 |

| Homewares | $289 |

| Liquor | $256 |

| Property Tax | $228 |

| Smith Manoeuvre Mortgage Pre-Payment | $214 |

| Electricity | $163 |

| Travel | $148 |

| Sports | $140 |

| Education | $93 |

| Internet | $87 |

| Home Insurance | $41 |

| Pets | $32 |

| Entertainment | $31 |

| Postage | $26 |

| Charity Donation | $20 |

| Apple Music Subscription | $17 |

| Netflix | $16 |

| Delivery Fees | $16 |

| RunKeeper | $16 |

| Apple Fitness+ Subscription | $15 |

| Adobe Subscription | $15 |

| Tech Donation | $13 |

| Cellphones | $12 |

| Disney+ | $10 |

| Gift | $9 |

| Online Storage | $4 |

| TOTAL | $8,778 |

Our spending this month was higher than normal again. One reason for that is the furniture expenditure of $1,390, which is actually a part payment for bedroom furniture that we bought earlier in the year. Although we paid for everything upfront, for budgeting purposes, we are spreading the cost over our March, April and May budgets.

Other big expenditures in April included clothing, at $564. We don’t tend to spend a lot of money on clothes, but every year or so, jeans and t-shirts do wear out and need replacing! I also invested in a base layer to keep me warm when sitting outside with friends during these colder spring months… but then the weather warmed up. Oh well, it’ll be great for fall and winter!

Medical expenses were high at $340. This was exclusively physio for my recovering broken wrist and a myriad of running injuries we always seem to have! Some of it was reimbursed through insurance, but we are beginning to max out those allowances.

Homewares expenditure at $289 is another odd one that we don’t usually spend much on. This month, we bought some items for the kitchen and balcony planters, but largely this expense came from buying a buckwheat hull pillow, which I am hoping will be the last pillow I ever need to buy!

On that cozy note, I’ll simply say that yes, I know, we spent a lot of money on furniture and homewares lately. It’s a slippery slope. I’m looking forward to getting the final furniture budget done in May, so we can start saving more again, and forget about furniture for a while.

FIRE Savings

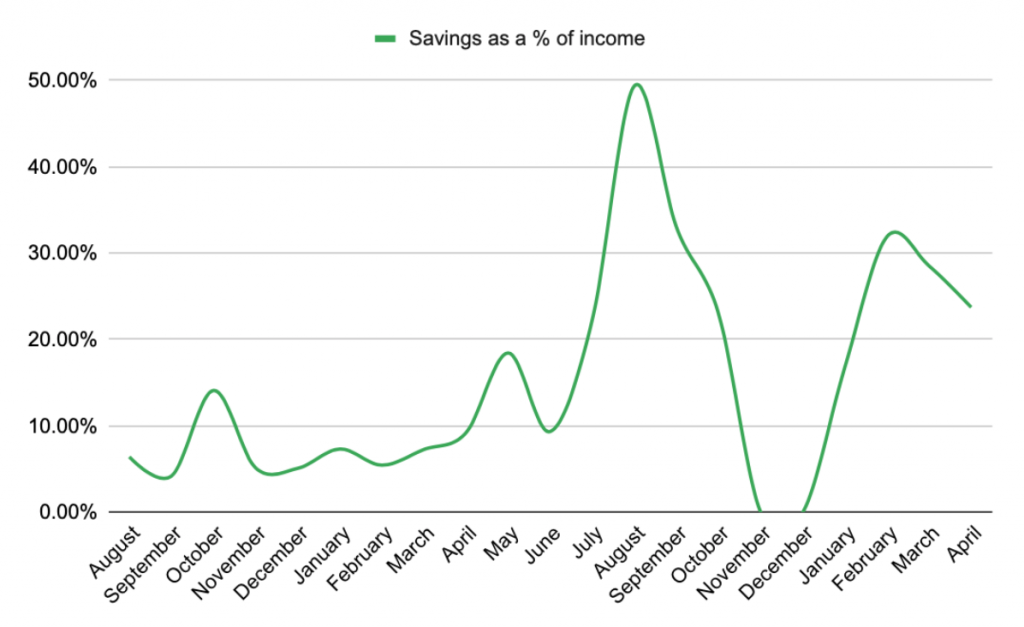

After balancing our budget, we had $2,724 left to put towards our FIRE savings. This has kept our savings as a percentage of our income hovering above 20%:

Our total FIRE fund value also increased in the last month, rising to $256,249 as of April 30.

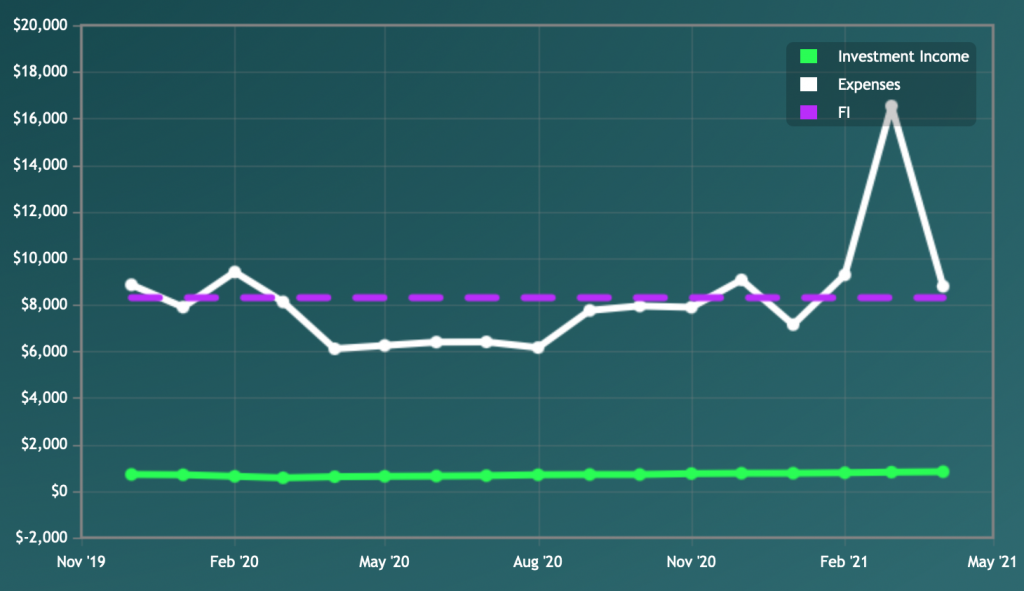

Plugging all these numbers into the Mad Fientist‘s FI Laboratory gives me the below graph, and the expected FI date of Nov 2041.

(Sure, I know it’s not the whole picture, but I like to input the numbers and see the progress.)

According to the FI Laboratory, that FI date is the same as the one we got last month, which is simultaneously frustrating and reassuring. Frustrating, because I want to make more progress towards our FIRE goal, but reassuring, because it means we haven’t got further away.

Now, it’s halfway through May – and I’m looking forward to getting through this month and into June, with hopefully high levels of vaccinations and the relaxation of COVID-19 restrictions!

I’m Daisy, the writer behind Fire by the Sea, my blog all about seeking financial independence in Vancouver, Canada. I love hiking, snowboarding, travelling, and cheese. You can read more about me, and my partner Tim, right here.

Contact me at daisy@firebythesea.ca.