We made it to the end of 2020 folks! For us, the final month of this weird, weird year began with provincial orders which meant we would be almost locked down, with no socializing, at Christmas.

Initially, this threw us into a bit of a downward spiral. But gradually, December grew from a month of isolation and depression into one of food and friendship. It was Christmas, after all.

So how did we make out financially in December – especially at Christmas? Let’s unwrap the numbers…

Income

| Paycheques | $3,186 |

| Employment Insurance | $2,056 |

| Emergency Fund | $1,719 |

| Mortgage Transfer Proceeds | $1,207 |

| Mortgage Transfer Bonus | $500 |

| BC COVID-19 Recovery Benefit | $473 |

| Parking Spot Rent | $50 |

| Freelancing | $41 |

| Referral Bonus | $20 |

| Reimbursement | $18 |

| Credit Card Cashback | $8 |

| Interest Income | $2 |

| TOTAL | $9,280 |

Work-wise, once again, Tim was unemployed this month, so we just had my paycheque of $3,186, and his EI of $2,056. But overall our income this December was higher than I was expecting.

That’s because this month, we renewed our mortgage, and moved from Scotiabank to Manulife. This is the first time we’ve transferred a mortgage, and there were proceeds of the transfer that we weren’t expecting of $1,207. We also unexpectedly received a $500 mortgage transfer bonus.

On top of that, in December, the BC provincial government launched the BC Covid-19 Recovery Benefit, offering $1,000 for eligible families and single parents and up to $500 for eligible individuals. We applied, and based on our household income, were eligible for $473.

As usual, $50 came from renting out our parking space to a neighbour every month. Tim also made $41 selling some of his photos online, and we received a $20 bonus for signing up to EQ Bank. We were refunded $18 for returning a gift that we had bought, but decided wasn’t right.

Plus there was a little bit of interest income ($2) and credit card cashback ($8).

So – with a higher income than expected, we should have been good to go, right? Well, perhaps. But this was December, and Christmas was coming – with big expenses.

So, we topped up our income with some emergency savings. I’ve recorded it here as income, for clarity. We took double the amount that we took last month – $1,719 – to balance the budget.

Expenses

| Mortgage | $3,610 |

| Christmas | $1,954 |

| Groceries | $814 |

| Liquor | $605 |

| Strata Fees | $504 |

| Education | $445 |

| Property Tax | $228 |

| Transport | $220 |

| Tech Savings | $100 |

| Internet | $87 |

| Takeout | $84 |

| Electricity | $75 |

| Charity Donation | $70 |

| Cellphones | $46 |

| Home Insurance | $41 |

| Credit Card Interest | $30 |

| Pets | $37 |

| Entertainment | $32 |

| Clothing | $26 |

| Apple Music Subscription | $17 |

| Adobe Subscription | $15 |

| Netflix | $14 |

| Disney+ | $10 |

| Online Storage | $3 |

| TOTAL | $9,067 |

Our spending in December was very high. So what happened?

Well, first of all, that mortgage transfer, which saw us make our regular mortgage payment to our old lender at the start of the month, then an interest-only payment to our new lender, at the end of the month. This meant we spent $3,610 on the mortgage this month. Luckily, those mortgage transfer proceeds and bonus more than covered that extra cost – and the mortgage payment will be lower starting in January!

Then came Christmas. At the start of December, I was all for having a fairly reasonable, low key Christmas. Provincial restrictions meant we couldn’t see anyone, except for a walk outside, which limited the spending that would even be possible, with no mouths to feed except ours, and no parties or get togethers on which to spend money.

In terms of family gifts – on my side of the family, we clubbed together with my sisters to buy gifts for our mom, but kept it very affordable, because one of my sisters spent most of 2020 unemployed due to COVID-19. As for gifts between sisters, one sister opted to receive a small contribution to a new kitchen appliance instead of anything big. The other sister opted out of exchanging gifts completely. I happily went along with their wishes.

On Tim’s side, we bought something small for his parents and brother, and then for his extended family, we did the regular Christmas Secret Santa draw, so we each only had one gift to buy (worth $150), instead of buying many gifts for every single one of his many relatives. They have been doing this for years and it works really well, I would highly recommend it.

We don’t do gift giving with our friends typically, so that just left Tim. Lucky for him, I was totally happy to splash out on him and get his heart’s desire – a Kitchenaid Artisan Tilt-Head Stand Mixer in Empire Red, on sale! Even better – Tim’s extended family Secret Santa chipped in!

So far, so reasonable. But, as the reality of being almost locked down for Christmas loomed larger, and the holiday restrictions got stricter for our families and friends in Europe too, we thought…. to hell with it. It’s been an awful year for so many people we know – let’s go big.

So, we decided to send Christmas presents to all our friends’ children around the world and cards to a whole ton of people to whom we would never normally write cards.

For the presents, we bought books from a local independent kids bookstore, then wrapped and mailed them out personally to about 30 families in Europe. (We try to avoid shopping on Amazon.)

For the cards, we tried our best to write heartfelt messages in cards that we already had in the house, plus some offered on the Buy Nothing Facebook group for our neighbourhood.

Other Christmas expenses included a new set of fairy lights for the balcony to illuminate the darkness, tickets to some drive-thru holiday lights, and some festive flowers to brighten the room.

All in all, the total cost of Christmas (not including food, which was covered by the regular groceries budget) was $1,954. The vast majority of that cost was presents and postage.

Could we have done it cheaper and smarter? Yes. But it was a spur of the moment decision to bring some joy to our friends and their kids, just when the world seemed at its darkest.

Also worth noting, throughout December, I was reading Unplug the Christmas Machine, by Jo Robinson and Jean C. Staeheli. This has helped us figure out what is important to us over Christmas – I highly recommend it. We will use it to help us plan better and spend less next year.

I guess the next question you might have is about how our groceries came to $814, including all Christmas food, which is a fairly average monthly grocery expenditure for us.

We achieved this by eating very frugally, mostly things we already had in the house, for the first half of December. Then, we splashed out on food for the week of Christmas. We hadn’t tried this “famine and feast” approach before, but it worked for December really well, and made us really appreciate our Christmas turkey dinner, and other delicious homemade meals over the holidays.

So what else is worthy of a mention this month? Our education spending was particularly high at $445, due to online courses and specialist books Tim bought to study while unemployed.

We spent $220 on transport – car sharing, car rental, and gas costs getting up to the local mountains for snowboarding and snowshoeing. This might seem high, but we used to pay about this amount in car insurance alone every month, so I keep it in perspective!

We did spend $84 on takeout this month, which is unusual for us. A friend gave us a voucher for UberEats, which we used, but then still had to pay any remaining balance plus a tip. As well, we found ourselves buying a lot of coffee on walks with friends (currently the only way to see anyone else is to go for a walk with them).

Our home insurance premium has gone up to $41/month, although it would have been higher if I hadn’t increased our deductible to get a discount. And once again, Tim forgot to pay a credit card, so got charged interest to the amount of $30. We had a serious chat about it, and he has set about automating all his credit card payments.

FIRE Savings

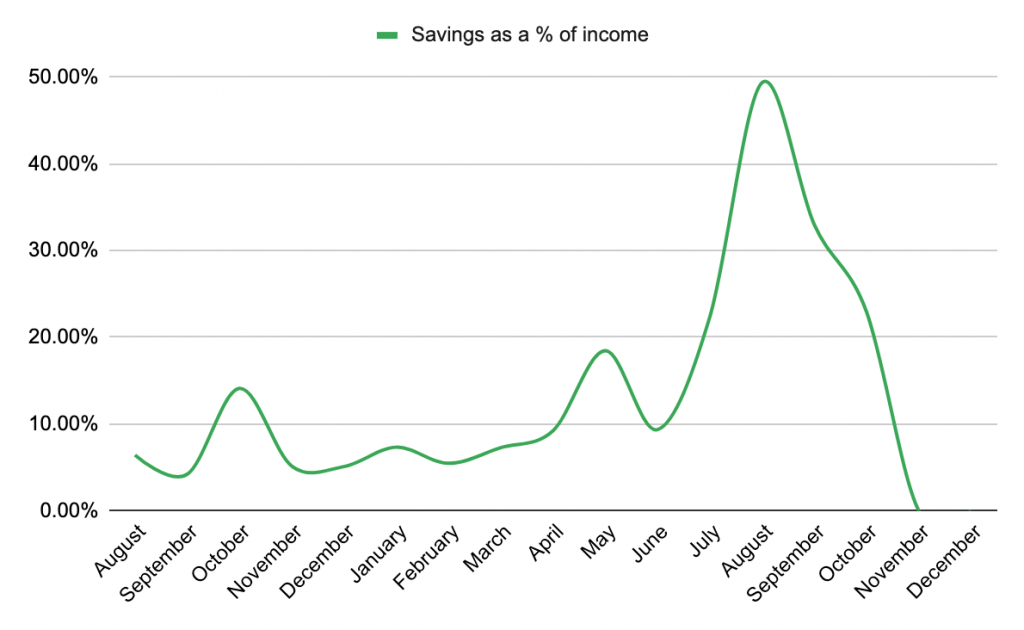

After balancing our budget, we again decided not to put anything towards our FIRE savings this month, and to hold onto our Emergency Savings for next month. Tim is starting a new job in January, so we’ll hold off until then. Still, it does mean the graph looks rather sad!

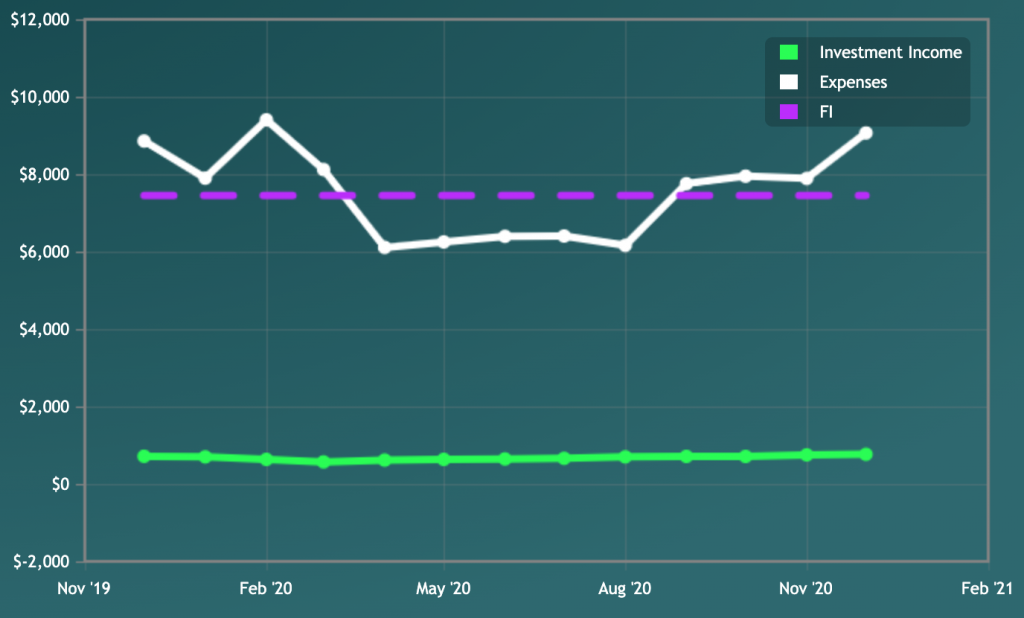

Due to market volatility, our total FIRE fund value has again actually increased, rising to $235,850 as of December 31, even though we didn’t contribute this month, which is great.

Plugging all these numbers into the Mad Fientist‘s FI Laboratory gives me the below graph, and the expected FI date of August 2043.

(Sure, I know it’s not the whole picture, but I like to input the numbers and see the progress.)

According to the FI Laboratory, that FI date is two months further away than the one we got last month, but at least it’s only a few months to make up, and I’m hoping we can do that next year.

Anyway, that’s all from me this month. I hope you’re getting through your down days and having some up days. I hope you can enjoy the holidays, however you’re able to celebrate. Stay safe.

I’m Daisy, the writer behind Fire by the Sea, my blog all about seeking financial independence in Vancouver, Canada. I love hiking, snowboarding, travelling, and cheese. You can read more about me, and my partner Tim, right here.

Contact me at daisy@firebythesea.ca.

1 thought on “December 2020: Income, Expenses, and Savings”