There’s no escaping it, this month was tough. Tim is still unemployed and Covid-19 is still here – bringing with it lockdowns and loneliness. But there is hope on the horizon in lots of areas!

So let’s look to the past and the future through the lens of our November finances.

Income

| Paycheques | $3,185 |

| Employment Insurance | $3,088 |

| Emergency Fund | $952 |

| Credit Card Cashback | $263 |

| Reimbursement | $392 |

| Parking Spot Rent | $50 |

| Great Canadian Rebates | $26 |

| Interest Income | $11 |

| TOTAL | $7967 |

In November, we combined my paycheques with Employment Insurance that Tim claimed to help with cashflow.

Handily, we also received some credit card cashback we weren’t expecting from our Rogers World Elite Mastercard and Scotia Momentum VISA Infinite cards – and our first ever payout from Great Canadian Rebates, which we’ve been using for ages, so it was satisfying to see it actually pay off.

Due to Covid-19 restrictions, we had to cancel our anniversary trip to Vancouver Island at the last moment. This meant we got reimbursed for the Airbnb booking – more cashflow help.

And as usual, the $11 of interest income came from our high interest TFSAs at Tangerine, and $50 came from renting out our parking space to a neighbour every month.

However, in the end, we could see our income level would lead to a shortfall this month, so we topped it up with funds from our emergency savings. I’ve recorded it here as income, for the sake of clarity. Thankfully, we only needed to take $952 to make the budget balance.

Expenses

| Mortgage | $2,930 |

| Strata Special Levy | $918 |

| Groceries | $813 |

| Liquor | $571 |

| Entertainment | $523 |

| Strata Fees | $504 |

| Appraisal | $268 |

| Property Tax | $228 |

| Eating or Drinking Out | $223 |

| Hardware/Software | $193 |

| Tech Savings | $100 |

| Internet | $87 |

| Transport | $83 |

| Charity Donation | $75 |

| News | $69 |

| Pets | $57 |

| Sports | $52 |

| Cellphones | $46 |

| Home Insurance | $34 |

| Education | $34 |

| Apple Music Subscription | $17 |

| Adobe Subscription | $15 |

| Gift | $14 |

| Netflix | $14 |

| Public Transit | $10 |

| Disney+ | $10 |

| Online Storage | $3 |

| TOTAL | $7,891 |

Our spending in November was slightly less than in October, as we reduced our grocery bill a little and tried to hold back on purchases as much as we could, mindful of Tim’s unemployment.

Whilst there were some big expenses nonetheless, there is good news on the horizon in lots of different expenditure areas… Let’s break it down and confess all.

We begin as ever with the biggest expense, the mortgage, at $2,930. Thankfully, we are renewing in December at a much lower interest rate, so this should decrease the payment starting January!

Next, that strata special levy of $918. As I mentioned last month, this is an extra contribution on top of our regular monthly strata fees to fund a big job in our building. This is the last instalment!

Onto groceries, which we managed to keep at $813 this month. On the one hand, we splashed out on some expensive steak and other delicious food for our anniversary. On the other hand, we ate frugally for the rest of the month, including some of our favourite dishes from Budget Bytes.

After trying to keep the liquor costs down in October, these rose considerably in November, as we went back into almost total lockdown and began drowning our sorrows again. The $571 we spent this month includes a wine club delivery and some high quality whisky and gin.

Our entertainment spending this month was massive at $523. Here’s the confession – we bought a Nintendo Switch console, extra controller, the Mario Kart game, and an online subscription.

We did this for two reasons. 1) We wanted some lighthearted, bright games we could play quickly, to cheer us up on dark, lonely winter nights. 2) We have a lot of friends both here and around the world who play Switch online, so by subscribing, we hoped to increase our social interactions.

I’m happy to report that both of these reasons have been proven valid in our house, and we have spent lots of time on the Switch since we bought it, playing and chatting with friends online, which has really helped give us a boost as we weather this Covid winter. It was a good purchase.

Plus, we already had some savings in our Tech Fund, which went towards lowering the expense. For the equipment, game, and subscription, we paid $478 after accounting for the Tech Fund.

Our entertainment spending also included a month’s subscription to soccer games for $22, a movie rental (The Hunt for Red October) for $6, and an e-book (Re-Run The Fun) for $17.

As usual, our strata fees were $504 and our property tax was $228, but this month we also paid for a condo appraisal at $268, a requirement of our new mortgage provider. We’re getting a much lower mortgage rate than currently, so the short-term expense is worth it.

At the start of November, we did spend quite a lot on eating and drinking out, at $223, but this was effectively over when new Covid-19 rules meant we could not socialize with anyone from outside our household. We have so far managed to remain frugal, and resist getting takeouts.

Our software and hardware spend this month was big, at $193. This was largely because Tim volunteered to help out a non-profit with a live online event and ended up buying loads of equipment and apps to make his equipment work for the event they wanted. We don’t mind, as it was for a good cause, and he gets to keep all the software and hardware that he purchased.

Moving down the list, I’ll just pick out some highlights now. We spent $83 on transport, mostly hiring Evo cars to transport equipment for the non-profit event. We also gave a total of $75 to charities this month, including Médecins Sans Frontières, the Wikimedia Foundation, and the BC Parks Foundation, who were fundraising to buy a private local island and protect it for British Columbia’s flora and fauna. They succeeded! Here’s a photo:

On that happy note, I will finish up. Sure, we spent more than I wanted at $7,891, but given the circumstances, I think we did OK. And we only needed to use $952 of our Emergency Funds, which means there’s still plenty left in the savings account to get us through December.

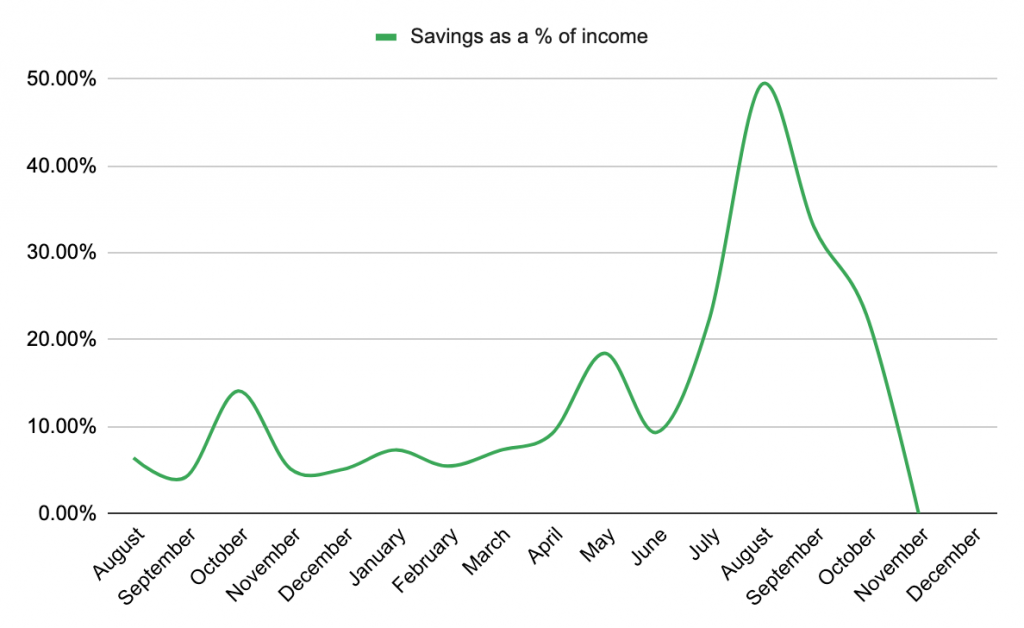

FIRE Savings

After balancing our budget, we decided not to put anything towards our FIRE savings this month, and to hold onto our Emergency Savings for next month. We are hoping Tim will find work in January, so we’ll hold off until then. Still, it does mean the graph looks rather sad!

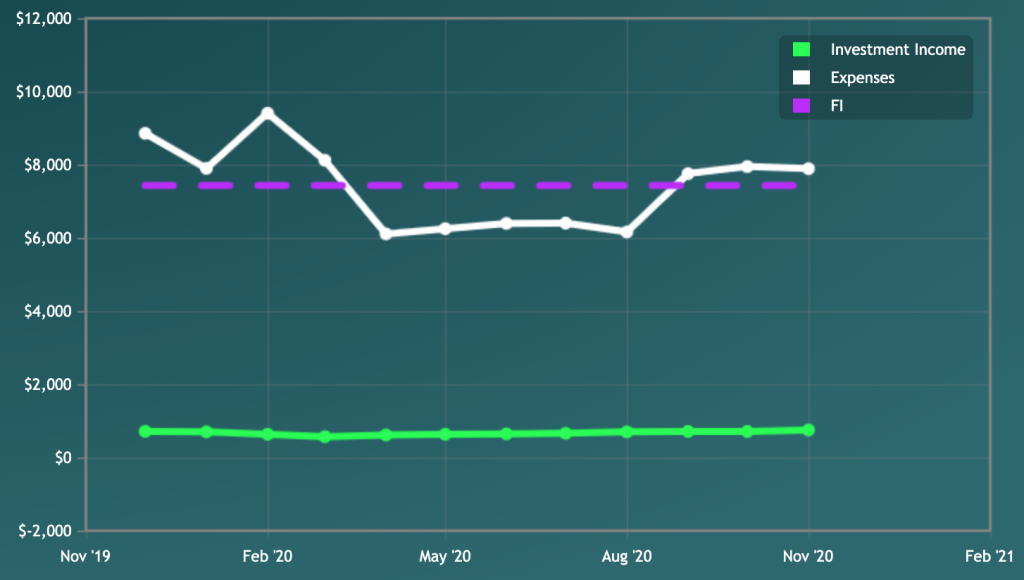

Due to market volatility, our total FIRE fund value has actually increased to $231,470 as of November 30, even though we didn’t contribute in November, which is great.

Plugging all these numbers into the Mad Fientist‘s FI Laboratory gives me the below graph, and the expected FI date of June 2043.

(Sure, I know it’s not the whole picture, but I like to input the numbers and see the progress.)

According to the FI Laboratory, that FI date is four months further away than the one we got last month, but at least it’s only a few months to make up, and I’m hoping we can do that next year.

On a personal note, as we head into December, isolated, cold, and dark, with little hope of a sociable Christmas, it’s fair to say we have our down days and our up days. (Today is an up day.)

But we are dedicated to the fight against Covid-19. We are staying home and hunkering down. We see friends online, or on walks in the open air only. A vaccine will be coming soon.

We know that, just like in battle, when you know the cavalry is on the way, you don’t stop fighting. You need to keep resisting and hold the line – so that vaccine can kick some ass when it gets here!

Anyway, that’s all from me this month. I hope you’re getting through your down days and having some up days. I hope you can enjoy the holidays, however you’re able to celebrate. Stay safe.

I’m Daisy, the writer behind Fire by the Sea, my blog all about seeking financial independence in Vancouver, Canada. I love hiking, snowboarding, travelling, and cheese. You can read more about me, and my partner Tim, right here.

Contact me at daisy@firebythesea.ca.